how to lower property taxes in maryland

However there are some little things you can do to reduce your property tax burden without resorting to living in a dump. This detailed report tells you everything you need to know about reduc.

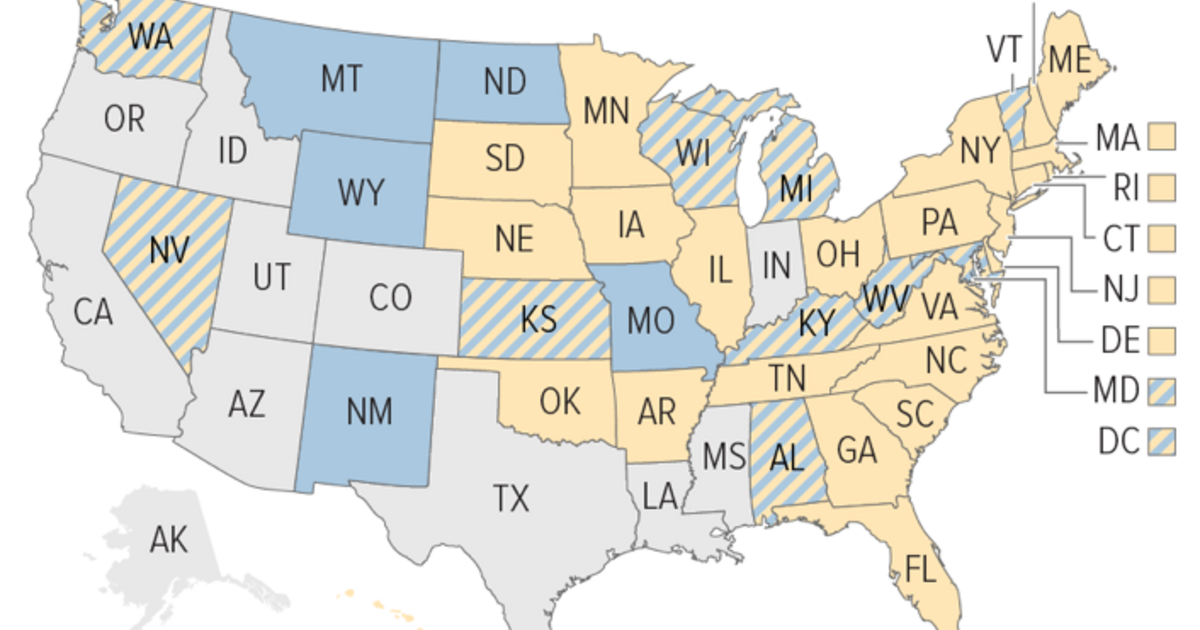

Disabled Veteran Property Tax Exemptions By State And Disability Rating

How to File a Property Tax Appeal.

. You will never be free from property taxes while you own your home but there are a. Contact us today and see how our tax experts can represent you and lower your assessed tax value then. How To Lower Property Taxes.

Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. Property Tax Exemption- Disabled Veterans and Surviving SpousesArmed Services veterans with a permanent and total service. You can score a bigger tax cut by challenging the assessed value of your home which is used to calculate your tax bill.

One of the easiest ways to lower your property tax is to show that your home is worth less than its assessed value. We strive to save Texans money on home or commercial property taxes. Avoid making any improvements right before your house.

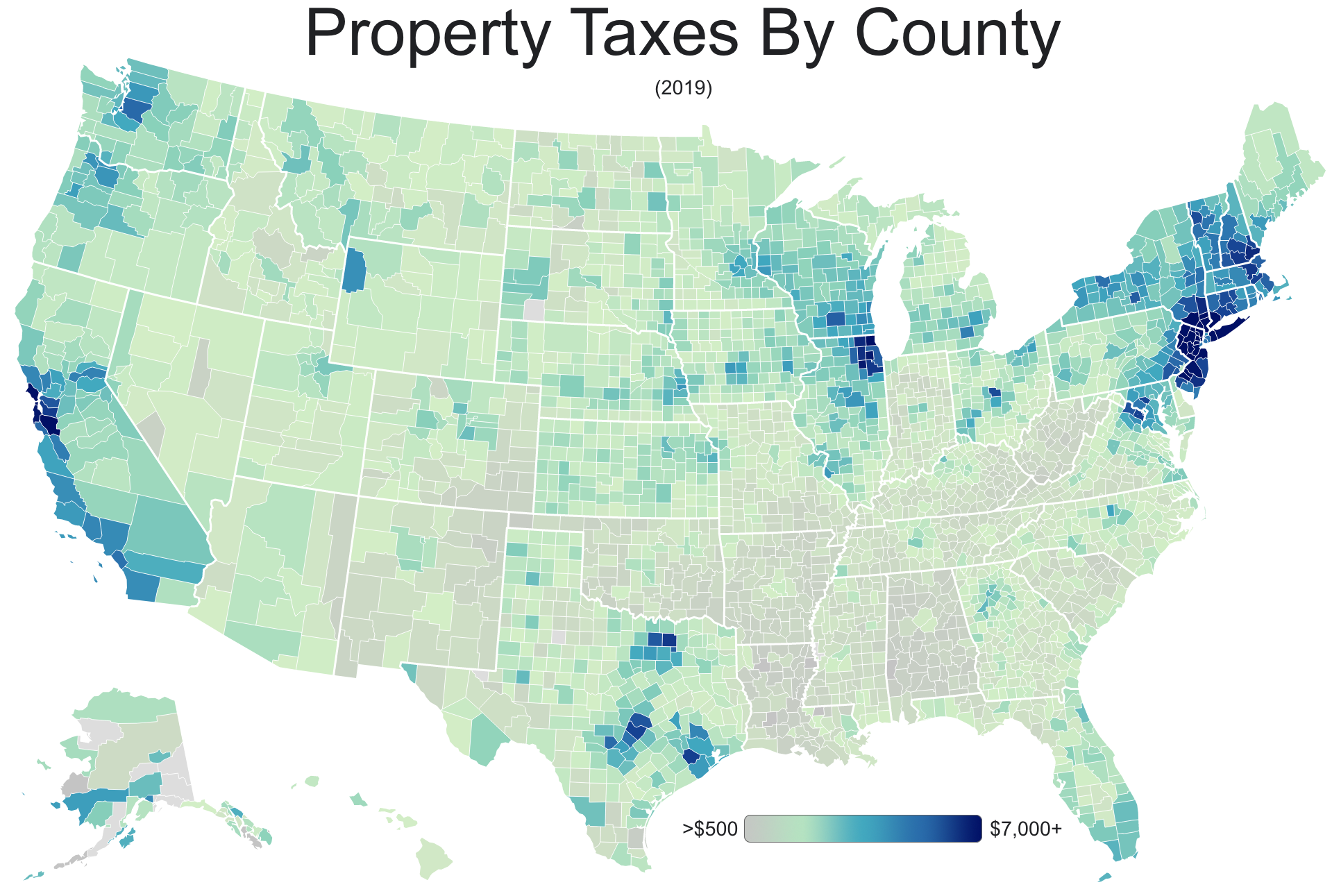

Maryland has one of the highest average property tax rates in the country with only ten states levying higher property taxes. See If You Qualify For Tax. Property tax bills are issued in JulyAugust of each year by Marylands 23 counties and Baltimore City as well as the 155 incorporated municipalities in Maryland.

This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland. Exemptions can reduce the amount of Maryland property taxes. For more information call the Maryland Tax Credits Telephone Service at 410-767-4433 or 1-800-944-7403 or visit the Maryland Tax Credit Programs and Exemption.

Even after you pay off your mortgage the tax bills keep coming. Marylands median income is 86881 per year so the median. New Yorks senior exemption is also pretty generous.

Limit Home Improvement Projects. Research Neighboring Home Values. Tax bills are rendered for the.

Only households with a total gross income of less than 60000. Another important tax credit is the Homeowners Property Tax Credit. Who is exempt from paying property taxes in Maryland.

How can I lower my property taxes. This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland. How Can I Lower My Property Tax Assessment in Maryland.

Property tax exemptions are a great way of reducing high property taxes. Do property taxes ever stop. How can I lower my property taxes in Maryland.

The credit caps property taxes based on income level. However they dont apply to levies and special taxes. In Maryland as is the case in other states these exemptions exist to offer help with paying property taxes for.

There are a few ways to go about. The most common ways to reduce your property tax liability are avoiding home improvement projects making sure your tax bill is. For more information call the Maryland Tax Credits Telephone Service at 410-767-4433 or 1-800-944-7403 or visit the Maryland Tax Credit Programs and Exemption Information.

The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your property. This detailed report tells you everything you need to know about reduc.

Go to your tax assessors website for details. They include senior and homestead exemptions. Most likely payment of your real property tax is handled through your mortgage lender but you can view local property tax rates on SDATs Web site.

Personal property generally includes.

Maryland State Offer In Compromise Overview Eligibility Forms And More

Property Taxes By County Interactive Map Tax Foundation

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

Tax Credits Deductions And Subtractions

Maryland State Tax Guide Kiplinger

Texas Voters Will Decide Whether To Lower Some Property Tax Bills In May Election Kera News

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Property Tax In The United States Wikipedia

Floyd Company Maryland Property Tax Reduction Specialists

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Maryland Property Taxes By County 2022

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group